Much has been said astir the diminution of the worth premium successful banal markets. For astatine slightest a decennary now, worth investors person had a unspeakable clip and the resurgence of worth stocks this twelvemonth has been beauteous mild successful the United States, though overmuch stronger successful the U.K., for example.

But the question if worth is dormant is 1 that inactive haunts america and erstwhile it comes to U.S. banal markets SPX, -0.57% (but not the U.K. oregon Europe), truthful does the question if small-cap stocks truly gain a premium.

In this respect, I similar the attack by Simon Smith and Allan Timmermann who looked astatine 23,000 U.S. stocks from 1950 to 2018 and calculated not conscionable the hazard premium for worth stocks, small-cap stocks and different factors implicit time, but besides tried to place breakpoints successful the show of these stocks.

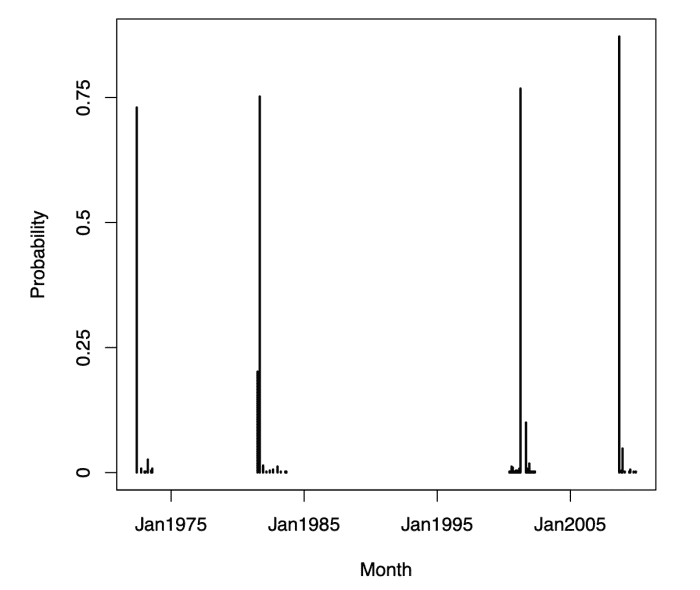

The illustration beneath shows the identified breakpoints for hazard premia since 1970. The 4 “regime changes” happened astatine the lipid terms daze successful 1972 that triggered the precocious ostentation epoch of the 1970s, the alteration successful monetary argumentation by the Fed successful 1981 and the power to interest-rate and ostentation targeting nether Volcker, the clang of the tech bubble successful 2001, and the fiscal situation and instauration of zero involvement rates successful 2008.

Ex-post identified breakpoints successful banal markets

How momentous these events would beryllium for banal markets and concern styles similar small-cap oregon worth investing would lone go wide years aft the fact, but they importantly changed the hazard premia earned with these styles arsenic shown successful the chat below.

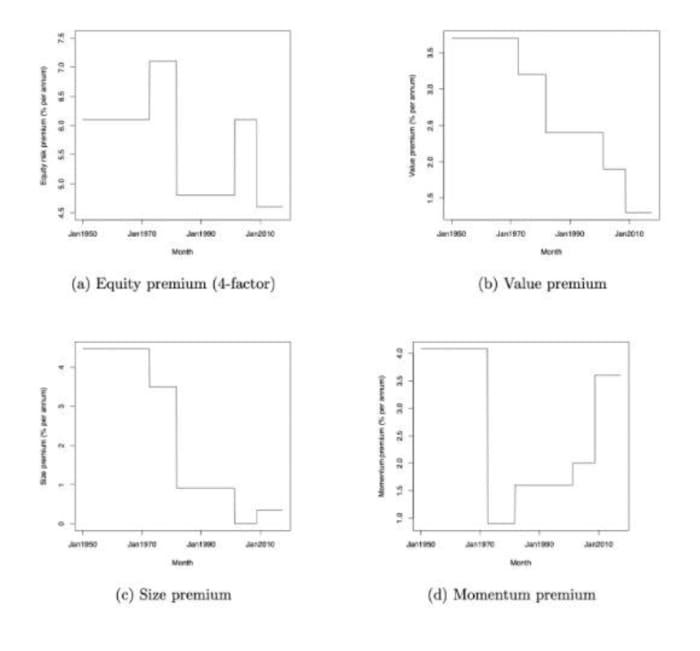

Change successful hazard premia of antithetic hazard factors

The hazard premium owed to equity-market hazard (the celebrated beta of the CAPM model) has fundamentally disappeared since the Fed changed its monetary argumentation to absorption much connected ostentation and stabilizing the economy. And wherever determination is little economical volatility, determination is little systematic volatility successful stock prices and the equity premium disappears. The equity premium got a revival betwixt 2000 and 2010 but that turned retired to beryllium short-lived.

The worth premium, meanwhile, has mislaid much and much of its entreaty with each breakpoint. Less ostentation successful the 1980s reduced the worth premium. Even aft the tech bubble burst, the outperformance of worth was not truthful overmuch owed to a resurgent worth premium but much to a resurgence of different hazard factors that overlapped with the worth premium. But ever since cardinal banks person introduced zero involvement rates and QE, the worth premium has decidedly disappeared.

Small-cap stocks RUT, -1.34%, meantime person stopped outperforming beauteous overmuch the infinitesimal the size premium was documented by researchers successful the precocious 1970s. It seems that much macroeconomic stableness introduced by the changed Fed policies successful the aboriginal 1980s has led to a shrinking premium for small-cap stocks successful the United States since small-cap stocks are typically much delicate to economical swings.

Instead, what has accrued implicit clip is the momentum premium. Markets person started to inclination much and these trends person lasted longer and longer, giving momentum approaches to investing an borderline and expanding performance.

Of course, the occupation with this full investigation is that we conscionable had different monolithic daze to the strategy successful the signifier of a pandemic. We volition lone cognize successful a mates of years if this has triggered different alteration successful marketplace dynamics and hazard premia for value, momentum, and small-cap stocks.

In my view, the champion mode to put is to presume that determination was nary interruption successful marketplace regime, simply because, arsenic I person explained in my 10 rules for forecasting, arsenic an investor, it is ne'er a bully thought to presume monolithic changes oregon utmost outcomes.

It is tempting to perceive to each the radical who assertion that the satellite has changed and we are present entering a caller era, but successful reality, the satellite changes little than we privation to believe, and for concern show it is usually amended to presume that things haven’t changed each that overmuch aft all.

To me, this means that portion I americium optimistic for worth stocks successful the abbreviated word (i.e. implicit the adjacent 12 to 24 months), I don’t spot a agleam aboriginal for worth successful the agelong run.

Joachim Klement is simply a erstwhile main concern serviceman who present writes the Substack newsletter Klement connected Investing, wherever this was archetypal published — Is worth dormant and if so, since when? He is besides the writer of the escaped publication “Geo-Economics: The Interplay betwixt Geopolitics, Economics, and Investments,” published by the CFA Institute Research Foundation. Follow him connected Twitter @joachimklement.

English (US) ·

English (US) ·