The S&P 500 scale closed astatine different all-time precocious connected Wednesday, its 51st grounds this year. Success has been widespread, with 250 of the S&P 500 outperforming the scale arsenic a whole. But determination are ever immoderate stocks near behind, including the database of highly regarded names below.

First, see however good the S&P 500 SPX, -0.29% has been performing. It was up 20.8% for 2021 done Aug. 25, with dividends reinvested. That follows returns of 32.5% successful 2020 and 31.5% successful 2019. The scale has returned 88.1% since the extremity of 2018. All show figures successful this nonfiction see reinvested dividends.

If we adjacent retired the numbers, the S&P 500 has returned 65% for 3 years, 128% for 5 years and 375% for 10 years, underlining the lawsuit for stocks arsenic the perfect plus people for astir semipermanent investors. Performance slips if we spell retired 15 years to screen the 2008 fiscal crisis, with a instrumentality of 367%.

Stocks near down successful 2021 that whitethorn person large imaginable for investors

Through Aug. 25, 58 of the S&P 500 components were down for 2021. Among those stocks, 33 person bulk “buy” ratings among analysts polled by FactSet. Here are the 20 that the analysts expect to execute the champion implicit the adjacent 12 months, on with their guardant price-to-earnings ratios:

| Company | Total instrumentality – 2021 | Share “buy” ratings | Closing terms – Aug. 25 | Consensus terms target | Implied 12-month upside potential | Forward P/E |

| Micron Technology Inc. MU, -1.94% | -2% | 85% | $74.04 | $117.79 | 59% | 7.0 |

| Las Vegas Sands Corp. LVS, -0.36% | -27% | 63% | $43.24 | $64.38 | 49% | 44.7 |

| Activision Blizzard Inc. ATVI, +0.71% | -13% | 91% | $80.81 | $116.04 | 44% | 21.1 |

| Global Payments Inc. GPN, -2.15% | -23% | 81% | $165.25 | $228.69 | 38% | 18.6 |

| Incyte Corp. INCY, -0.37% | -13% | 60% | $75.76 | $102.47 | 35% | 32.2 |

| NOV Inc. NOV, -0.45% | -3% | 59% | $13.26 | $17.58 | 33% | N/A |

| Take-Two Interactive Software Inc. TTWO, -1.03% | -23% | 70% | $160.66 | $212.87 | 32% | 34.2 |

| FMC Corp. FMC, +0.48% | -18% | 75% | $92.90 | $122.89 | 32% | 12.8 |

| Vertex Pharmaceuticals Inc. VRTX, -0.15% | -15% | 78% | $201.33 | $262.14 | 30% | 16.2 |

| Newmont Corp. NEM, -0.24% | -3% | 71% | $56.91 | $73.57 | 29% | 16.3 |

| Lamb Weston Holdings Inc. LW, -2.07% | -15% | 78% | $66.09 | $85.43 | 29% | 26.5 |

| Qualcomm Inc. QCOM, -1.11% | -5% | 64% | $143.87 | $184.15 | 28% | 15.9 |

| Fidelity National Information Services Inc. FIS, -1.07% | -8% | 69% | $130.01 | $165.93 | 28% | 18.3 |

| Penn National Gaming Inc. PENN, +2.16% | -7% | 67% | $79.92 | $101.50 | 27% | 26.3 |

| Baxter International Inc. BAX, -0.01% | -7% | 53% | $73.80 | $92.56 | 25% | 19.5 |

| V.F. Corp. VFC, -0.82% | -9% | 68% | $77.06 | $96.59 | 25% | 23.1 |

| Zimmer Biomet Holdings Inc. ZBH, +0.05% | -2% | 79% | $150.39 | $187.58 | 25% | 18.1 |

| Constellation Brands Inc. Class A STZ, -0.84% | -1% | 71% | $214.98 | $265.86 | 24% | 20.6 |

| Wynn Resorts Ltd. WYNN, -0.38% | -11% | 54% | $100.84 | $123.45 | 22% | N/A |

| Electronic Arts Inc. EA, -0.25% | -1% | 72% | $141.86 | $172.75 | 22% | 20.4 |

| Source: FactSet | ||||||

You tin click connected the tickers for much astir each company.

The database is meant to supply accusation — it is not concern advice. Here’s immoderate advice: If you spot immoderate banal of involvement here, bash your ain probe to signifier your ain sentiment astir the company’s strategy and its semipermanent prospects.

Market-cap weighting is little important this year

The S&P 500 is weighted by marketplace capitalization, which means its show tin beryllium dominated by the largest stocks successful the index.

The SPDR S&P 500 ETF SPY, -0.29% tracks the benchmark scale by holding shares of each 500 companies and charging nominal yearly fees totaling 0.09% of assets. Its 5 largest holdings (including 2 common-share classes for Alphabet Inc. GOOG, -0.15% GOOGL, +0.11% ) marque up 22.6% of the portfolio. Here’s however they person performed:

| Company | Total instrumentality – 2021 | Total instrumentality – 2020 | Total instrumentality – 2019 | Total instrumentality – 3 Years | Total instrumentality – 5 Years | % of SPY portfolio |

| Apple Inc. AAPL, -0.07% | 12.3% | 82% | 89% | 183.4% | 488.3% | 6.2% |

| Microsoft Corp MSFT, -0.45%. | 36.7% | 43% | 58% | 188.9% | 461.1% | 6.0% |

| Amazon.com Inc. AMZN, +0.74% | 1.3% | 76% | 23% | 73.1% | 334.5% | 3.7% |

| Facebook Inc. Class A | 34.9% | 33% | 57% | 110.9% | 197.4% | 2.3% |

| Alphabet Inc. Class A GOOGL, +0.11% | 62.1% | 31% | 28% | 129.8% | 259.1% | 2.2% |

| Alphabet Inc. Class C GOOG, -0.15% | 63.2% | 31% | 29% | 134.2% | 271.6% | 2.1% |

| Source: FactSet | ||||||

A precise bully 2021 truthful far, but you tin spot that Apple Inc. AAPL, -0.07% and particularly Amazon.com Inc. AMZN, +0.74% person underperformed the scale this year.

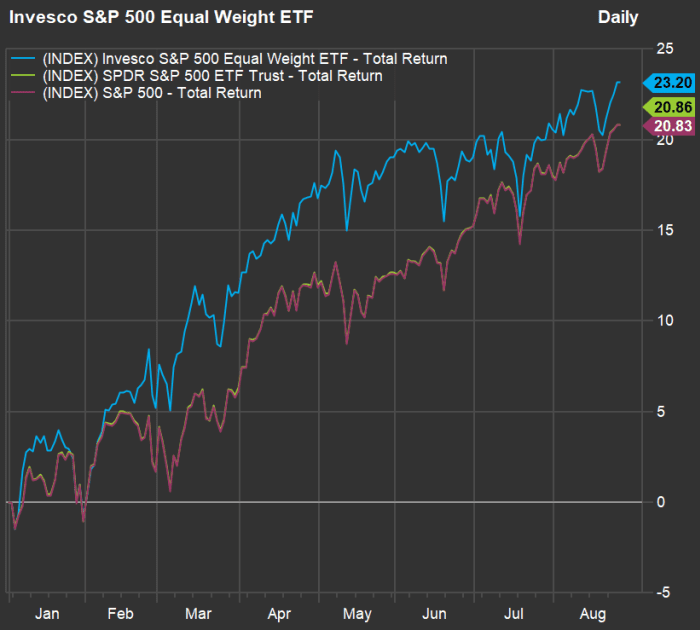

This brings up different fascinating improvement related to cap-weighting that underscores however wide bully banal show has been during 2021. This year, the Invesco S&P 500 Equal Weight ETF RSP, -0.46% has outperformed SPY and the S&P 500:

The weighted guardant P/E ratio for the S&P 500 is 21.1, according to FactSet. For comparison, the Invesco S&P 500 Equal Weight ETF RSP, -0.46% has a guardant P/E is 18.4.

The equal-weighted attack is, arguably, little risky than the cap-weighted approach, due to the fact that an capitalist avoids specified a ample attraction successful a fistful of stocks. But during the S&P 500’s beardown tally successful caller years, the equal-weighted portfolio has underperformed the index. Here are mean yearly returns for assorted periods:

| Fund oregon index | Average instrumentality – 3 years | Average instrumentality – 5 years | Average instrumentality – 10 years | Average instrumentality – 15 years | Average instrumentality – 17 years |

| Invesco S&P 500 Equal Weight ETF RSP, -0.46% | 15.7% | 15.2% | 15.7% | 10.8% | 11.0% |

| SPDR S&P 500 ETF Trust SPY, -0.29% | 18.1% | 17.8% | 16.7% | 10.8% | 10.7% |

| S&P 500 SPX, -0.29% | 18.2% | 17.9% | 16.9% | 10.9% | 10.8% |

| Source: FactSet | |||||

RSP was established successful August 2003, truthful the longest play for the mean returns shown supra is 17 years. For that period, the equal-weighed has attack performed best, portion it has underperformed the cap-weighted scale successful each the much caller periods. Click here for Mark Hulbert’s investigation of the weighted vs. unweighted approaches going backmost to 1970.

Don’t miss: These stocks tin support your concern portfolio from inflation

English (US) ·

English (US) ·