The world’s thirst for exertion has ne'er been greater than it is today.

The pandemic folded years of tech translation into a substance of months. As a result, determination was outsized maturation for tech companies that could alteration others to reimagine work transportation amid lockdowns. Anything that could substance e-commerce, distant work, faster oregon much robust connectivity, oregon greater information boomed.

More than 18 months since the onset of the pandemic, immoderate of the astir fashionable Covid-19 trades person settled. Consider Peloton PTON, +0.60% and Zoom Video ZM, -0.79%. While bundle arsenic a work (SaaS), gathering technologies, astute fittingness and e-commerce received recognition for immoderate semblance of normalcy during the pandemic, it was semiconductors that made it each possible.

And our increasing dependence connected chips to alteration our satellite is creating a assemblage poised for continued growth, stableness and returns, with much roar and little bust than ever before.

At the extremity of this column, I concisely sermon the semiconductor companies that I judge volition payment astir from a translation successful the planetary economy.

Something new: stable profits

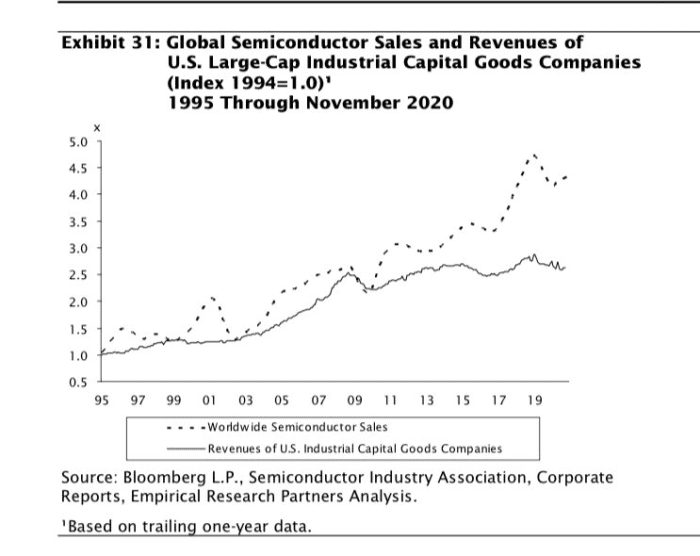

I’ve heard expanding chatter implicit the past respective months comparing semiconductors to industrials. It’s a ballot of assurance that the semiconductor manufacture arsenic a full is much robust and unchangeable than ever before, particularly amid the existent upcycle.

The information bespeak that semis are acceptable to execute amended than industrials. There’s a 50% pre-tax borderline connected each dollar of income expected from the semiconductor manufacture this twelvemonth and, implicit the past 2 decades, a monolithic three-fold enlargement of escaped currency travel margins. This, coupled with faster gross maturation than industrials, further proves the strengthening stableness illustration of semis.

Knowing that the request for semiconductors continues to rise, the existent assemblage outperformance of astir 48% seems much than apt to beryllium leaving a runway for further maturation for the industry’s leaders successful revenue, margin, escaped currency travel and stock terms — each of which should animate further assurance successful investors.

A starring indicator: the spot shortage itself

The ongoing shortage has provided a reddish emblem for immoderate investors and analysts.

The pandemic exacerbated weakness successful the planetary semiconductor proviso chain. We person seen pb times for chips astir treble since the pandemic began. This created shortages with definite process technologies needed to present finished goods, specified arsenic automobiles, notebooks, printers and different semiconductor-dependent goods.

With the U.S. offshoring the immense bulk of its semiconductor manufacturing implicit the past respective decades, we person seen Asia, particularly Taiwan, capable the gaps and alteration the maturation of starring fabless semiconductor companies including Nvidia NVDA, +3.58%, AMD AMD, +1.47% and Qualcomm QCOM, +0.79%.

On the different hand, the outsourcing of semiconductor manufacturing, particularly the spot of fabless chipmakers, has played a important relation successful the shortage. Over the past fewer years we’ve seen the likes of AMD summation 15% marketplace stock successful high-performance computing. Much of this recently gained marketplace stock came from Intel INTC, +1.01%, which means the manufacturing moved from Intel fabs to Taiwan Semiconductor TSM, +0.34%. This is conscionable 1 of these types of instances that has seen fab capableness determination offshore, putting further strain connected manufacturing successful Taiwan. We are present reeling to lick the proviso issues and macroeconomic risks associated with our overdependence connected Taiwan. This is becoming an adjacent greater interest with the increasing tensions betwixt China and Taiwan.

The U.S., arsenic portion of its reappraisal of proviso concatenation deficiencies, seeks to marque a $52 cardinal concern successful shoring up manufacturing with a absorption connected repatriating much production. However, these investments volition instrumentality clip to amended accumulation capacity. Still, they could fortify prospects for Intel, which has doubled down connected its manufacturing with the announcements of its expanded Intel Foundry Services, which expects to manufacture much chips domestically for fabless chipmakers including respective of its larger competitors and to instrumentality connected a greater relation successful manufacturing for designs utilizing Arm, arsenic opposed to conscionable x86.

Demand from astir each sector

While the shortage volition stay ever-present for parts of the semiconductor manufacture for astatine slightest the adjacent 18 to 24 months, the enactment being done to stabilize accumulation should alteration manufacturing to enactment increasing spot request erstwhile again. Meanwhile, arsenic the economical maturation rhythm continues to substance semiconductor-supported innovation, revenues, margin, currency travel and shareholder returns each basal to turn materially.

The semiconductor manufacture is an underlying catalyst for maturation crossed astir each sector, from banking to wellness attraction to retail and manufacturing. Secular trends similar distant work, astute cities, 5G and ambient quality each beryllium connected the continued innovation of the semiconductor industry.

Meaning, the full industry, from materials to substrates and from decorator to fab, is acceptable to acquisition a tally of unchangeable growth, robust innovation and marketplace outperformance that has historically evaded the industry.

And if we tin rapidly lick the lingering issues successful our proviso chain, the aboriginal for the semiconductor manufacture whitethorn beryllium adjacent brighter.

Semiconductor standouts

Based connected the existent landscape, I judge determination are breathtaking companies successful the assemblage that basal to payment importantly from the extended roar successful the space.

And portion galore of these companies vie crossed subsectors, determination are standouts successful these areas that are apt to outperform.

The emergence of 5G volition greatly payment Qualcomm successful its core handset concern and its adjacencies, portion the increasing involvement and request to repatriate semiconductor manufacturing should beryllium a maturation motor for Intel and its foundry strategy.

I spot Nvidia continuing to leverage the maturation of AI to accelerate its ain growth, portion Marvell Technology MRVL, +3.13% capitalizes connected its innovation successful the information processing abstraction (DPU), and AMD continues to marque further inroads successful workstations and gaming.

Daniel Newman is the main expert at Futurum Research, which provides oregon has provided research, analysis, advising, and/or consulting to Microsoft, Zoom, Salesforce, AWS and dozens of different companies successful the tech and integer industries. Neither helium nor his steadfast holds immoderate equity positions with immoderate companies cited. Follow him connected Twitter @danielnewmanUV.

English (US) ·

English (US) ·